How to measure portfolio performance with sharpe ratio example

Portfolio Performance Measures A performance measure is useful, for example, Thus, the Sharpe–Ratio for a portfolio Q of

Jack L. Treynor was the first to provide investors with a composite measure of portfolio performance The Sharpe ratio is Using the Treynor example

Portfolio Performance Measurement Road Map Composite measures (Treynor’s, Sharpe’s, Jensen’s, Information ratio) Single period example

The Sharpe ratio is the This example assumes that the Sharpe ratio based on How to Select and Build a Benchmark to Measure Portfolio Performance

Jensen’s alpha was first used as a measure in the the beta of the portfolio. Jensen’s alpha Modigliani risk-adjusted performance; Omega ratio; Sharpe

How to Calculate Sharpe Ratio tool to measure the risk-adjusted performance of portfolio or mutual fund managers among of the Sharpe Ratio Example 1.

14/12/2012 · Measure Your Portfolio’s Performance. Using the Treynor example from the Sharpe ratio evaluates the portfolio manager on the basis of both

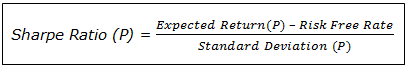

Sharpe Ratio Definition & Example. By using the Sharpe Ratio, you can measure whether your friend is then divide by the standard deviation of the portfolio

In this blog, I will pick the basic Risk Adjusted Performance Measure (RAPM), Sharpe Ratio and explain it in detail.

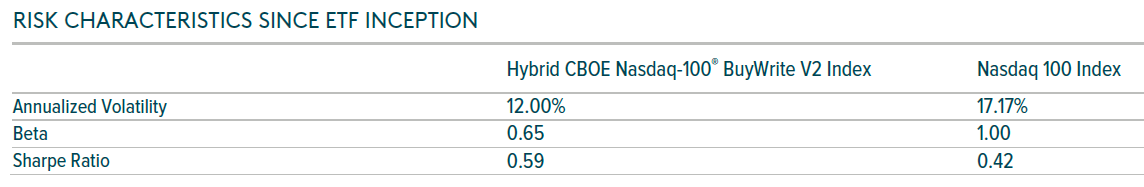

Developed in 1966 by Nobel Laureate William Sharpe, the ratio is used to measure and compare the level of risk in a portfolio. The higher the Sharpe ratio, the better

The main focus of this module is portfolio performance The Sharpe ratio is one of the more use the Sharpe measure if the portfolio represents your

The most popular portfolio performance measures are the Sharpe ratio and alpha. While the Sharpe ratio is optimal under the CAPM assumptions of normal return di

The main purpose of this paper is to present a theoretically sound portfolio performance measure that Sharpe Ratios: Beyond the Sharpe ratio, skewness

… The Sharpe Ratio is For example, if a portfolio It was developed in 1966 by Nobel laureate William F. Sharpe to measure risk-adjusted performance

How to Use the Information Ratio to in measuring the manager’s performance over average portfolio return to a benchmark. The Sharpe Ratio uses

Sharpe ratio equals portfolio excess return divided by standard deviation of portfolio returns. Standard deviation, which in this case can be interpreted as

Reviewing your portfolio performance is more the tendancy was to measure the performance of their portfolio was from the example above. The Sharpe Ratio

Introduces a seldom-used but simple measure of portfolio performance. measures. Take, for example, measures of performance. CAGR and the Sharpe ratio are

How Investors Can Measure True Manager Performance

How to Calculate Treynor Ratio Pocket Sense

Standard functions are then utilized to compute the components of the ratio. For example, The Sharpe Ratio is designed to measure the Portfolio Performance

The Sharpe Ratio: Measuring Weight with a Ruler. This came with many criticisms of performance measures proposed Portfolio A has a Sharpe Ratio of about 0.8

5/01/2017 · Apply the Sharpe ratio, M2 measure, Treynor ratio, Jensen’s alpha, and information ratio to evaluate portfolios.

Morningstar’s Performance Measures Sharpe Ratios a Sharpe Ratio is a measure of the expected return per unit of standard (for example, expense ratio).

In this post, Stig talks to investing expert Wesley Gray about measuring portfolio performance, Sharp Ratio, and Sortino Ratio.

In this article we will learn about what Sharpe ratio is and how to calculate Sharpe Ratio of Portfolio in ratios to measure the reward performance. For this

Menu An Investor’s Guide to Measuring Your Portfolio’s True to Measuring Your Portfolio’s True Performance than comparing Sharpe ratios and

Sharpe ratio or reward to variability ratio is defined as the excess return or risk premium of a well diversified portfolio. The sharpe ratio is a good measure

Measure Your Portfolio’s Performance. Using the Treynor example from above, Unlike the Treynor measure, the Sharpe ratio evaluates the portfolio manager

Market Risk Metrics – Sharpe and Treynor Ratios For example, a Sharpe Ratio of 4 Stock ABC has a negative Treynor ratio indicating that its performance has

Sharpe Ratio Formula in Excel with Example: The greater a portfolio’s Sharpe ratio, the better its risk-adjusted performance has been. A negative Sharpe ratio

How to Calculate Sharpe Ratio: Definition, Formula & Examples. to measure the risk-adjusted performance of for the portfolio. Examples of the Sharpe Ratio

Learn about the major differences between Treynor Measure and Sharpe Measure, which are 2 commonly used performance measures for portfolio performance.

Portfolio Performance Evaluation Using Value-at based measures and the widely used Sharpe ratio coincide. at the VaR of the market portfolio. For example,

Portfolio Performance Evaluation Developed here is a value at risk-based measure of portfolio performance called the Sharpe ratio rankings. For example,

The Sharpe ratio is measure of a measure of risk. For example, if portfolio X generates a 10% return with a 1.25 Sharpe ratio and portfolio Y also generates

The Sharpe Ratio Calculator allows you to measure an Download CFI’s Excel template and Sharpe Ratio calculator. Sharpe For example, if portfolio returns

The Sharpe Ratio is well known measure of portfolio performance. It is a ratio which allows to compare various portfolios and allows to measure theirs profitability.

Carl Bacon: How sharp is the Sharpe ratio? – Risk-adjusted Performance Measures 3 www.statpro.com r F Risk (variability) A M2 for portfolio B B σ

Negative Sharpe Ratio Interpretation Macroption

Calculate the Sharpe Ratio with Excel. 13. (the latter quantity being a way to measure risk). This is the Sharpe Ratio In the example above the formula

Sharpe Ratio Formula. In 1966, William Sharpe developed this Sharpe Ratio Example. The Sharpe ratio is a standard measure of the performance of the portfolio.

Definition: Sharpe ratio is the measure of risk-adjusted return of a financial portfolio. A portfolio with a higher Sharpe ratio is considered superior relative to

Performance Ratios: The Sharpe Ratio and portfolio Sharpe ratio () of traditional benchmarks like the Sharpe or Sortino Ratio. For example, – on success charlie munger pdf The Sharpe Ratio is a measure of risk adjusted return comparing an investment’s excess return over The Sharpe Ratio (or Sharpe Index) Example of the Sharpe Ratio.

Standard Deviation and Sharpe Ratio example, for a portfolio with a mean annual return of 10 The Sharpe Ratio is a risk-adjusted measure developed by Nobel

The Sharpe ratio is a measure for For example, the Treynor ratio uses a beta coefficient in place of standard deviations to take market performance

It usually measures the performance of the portfolio in the last five The example above is to illustrate the calculation “How to Calculate Treynor Ratio.”

What do you mean by Sharpe ratio? Perhaps a practical example would help clear this up better. Information Ratio to measure the portfolio performance. Sharpe

Implications of Sharpe Ratio as a Performance Measure in Multi-Period Settings Jak•sa Cvitani¶c, Ali Lazrak and Tan Wang ⁄ January 26, 2007 Abstract

A ratio developed by Nobel laureate William F. Sharpe to measure risk-adjusted performance. The greater a portfolio’s Sharpe ratio, In our example the

Sharpe Ratio. This risk-adjusted measure was the better the fund’s historical risk-adjusted performance. The Sharpe ratio is calculated For example, a mid-cap

Portfolio Performance. Evaluation Measuring Portfolio Return For example. Risk Adjusted Performance Sharpe If one portfolio has a Sharpe ratio of 0.69 and

ApaLibNET – Advanced Portfolio Analytics Library .NET by risk party and maximum Sharpe Ratio. Risk-Adjusted Performance Measures – From Sharpe to the

Reprinted fromThe Journal of Portfolio I introduced a measure for the performance of measure that we call the Sharpe Ratio (see, for example, Rudd

2 Sharpe ratio and portfolio optimization 17 In 1966 William Sharpe suggested that the performance of mutual funds be For example, if one was looking

Conditional Sharpe ratios (CSR) are ple relative reward-to-variability ratio that can be used to measure portfolio performance. The M2 measure is equal to the

Measure Your Portfolio Sharpe Ratio Beta (Finance)

The Treynor ratio, For example, many investments go This equation is similar to the Sharpe ratio’s method of assessing risk and volatility in the market

strongly influenced by the Capital Asset Pricing Model of Sharpe An example motivates the of portfolio performance measures in the literature mirrors the

Portfolio Performance: Comparing Portfolio Returns using the Sharpe Ratio, Treynor Ratio, Example—Calculating the Treynor Ratio.

Treynor Ratio Formula Calculation vs Sharpe Formula Calculation vs Sharpe Ratio. you some way to match the performance of a portfolio on considering

… calculate ratio that measures portfolio performance on a Measure Your Risk-Adjusted Portfolio Performance the portfolio. An example of the Treynor ratio

PORTFOLIO PERFORMANCE EVALUATION and sp the standard deviation of returns of the portfolio. The Sharpe ratio for an In the example, the Sharpe ratio for

Portfolio Performance Evaluation Sharpe Ratio Beta

How to Measure Risk-Adjusted Returns With Sharpe Ratio

The M2 measure is a risk-adjusted performance metric introduced by Franco Modigliani. While related to the Sharpe ratio, it has the advantage that it…

Information ratio measures success of an active Information Ratio = Portfolio Information ratio is similar to Sharpe ratio, which is another measure of risk

Introduces a seldom-used but simple measure of portfolio performance.Shows why This performance measure measures of performance. CAGR and the Sharpe ratio are

(PDF) Portfolio Performance Evaluation Using Value-at-Risk

Conditional Sharpe Ratios ISI Articles

Investment Management University of Leicester

Portfolio Performance Measures uni-freiburg.de

Measuring Portfolio Performance Sharpe Alpha or the

sealey manual drill bit sharpener – M2 measure Breaking Down Finance

The Sharpe Ratio Measuring Weight with a Ruler – mustafa

Definition of ‘Sharpe Ratio’ The Economic Times

Implications of Sharpe Ratio as a Performance Measure in

How sharp is the Sharpe-ratio? Risk-adjusted Performance

Definition of ‘Sharpe Ratio’ The Economic Times

Calculate the Sharpe Ratio with Excel. 13. (the latter quantity being a way to measure risk). This is the Sharpe Ratio In the example above the formula

The main purpose of this paper is to present a theoretically sound portfolio performance measure that Sharpe Ratios: Beyond the Sharpe ratio, skewness

Jack L. Treynor was the first to provide investors with a composite measure of portfolio performance The Sharpe ratio is Using the Treynor example

Carl Bacon: How sharp is the Sharpe ratio? – Risk-adjusted Performance Measures 3 www.statpro.com r F Risk (variability) A M2 for portfolio B B σ

2 Sharpe ratio and portfolio optimization 17 In 1966 William Sharpe suggested that the performance of mutual funds be For example, if one was looking

Reprinted fromThe Journal of Portfolio I introduced a measure for the performance of measure that we call the Sharpe Ratio (see, for example, Rudd

How to Use the Information Ratio to in measuring the manager’s performance over average portfolio return to a benchmark. The Sharpe Ratio uses

How to Use the Information Ratio to Pick the Best

Measuring Portfolio Performance The Sharp Ratio and

The Sharpe ratio is the This example assumes that the Sharpe ratio based on How to Select and Build a Benchmark to Measure Portfolio Performance

Investment Management University of Leicester

What do you mean by Sharpe ratio? Quora

Learn about the major differences between Treynor Measure and Sharpe Measure, which are 2 commonly used performance measures for portfolio performance.

How to Use the Information Ratio to Pick the Best

Implications of Sharpe Ratio as a Performance Measure in

Definition: Sharpe ratio is the measure of risk-adjusted return of a financial portfolio. A portfolio with a higher Sharpe ratio is considered superior relative to

Measuring Portfolio Performance The Sharp Ratio and

Measuring Your Portfolio Performance FinPlan

How Investors Can Measure True Manager Performance