The sharpe ratio william sharpe pdf

The Sharpe Ratio William F. Sharpe Stanford University Reprinted fromThe Journal of Portfolio Management, Fall 1994 This copyrighted material has been reprinted with permission from The Journal of Portfolio Management.

The classic Sharpe ratio assumes that Cash is riskless. In reality, a short-term cash rate is not necessarily riskless. In reality, a short-term cash rate is not …

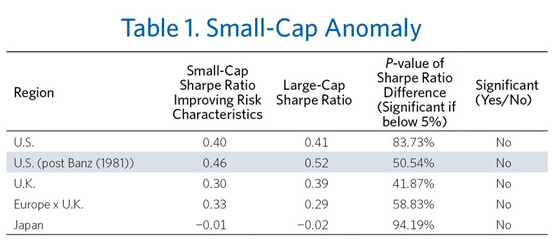

high Sharpe ratio managers should be compared with that of the optimal Sharpe ratio strategy. This has This has particular application in the hedge fund industry where …

5/11/2007 · Sharpe Ratio Developed by Nobel laureate economist William Sharpe, this ratio measures risk-adjusted performance. It is calculated by subtracting the risk-free rate of return (U.S. Treasury Bond

This article will clarify the difference in Calculation between Markowitz Covariance Model and Sharpe Index Coefficients. Sharpe’s Model: William Sharpe tried to simplify the Markowitz method of diversification of portfolios.

Sharpe ratio which was developed by William Sharpe in 1966, is one of the the most commonly used measures. It shows average return of the portfolio with the each excess risk taken. However, lots of academicians in the literature claimed that Sharpe Ratio does not give correct results especially when returns of the funds display non-normal distributions. Hence, variety of rules and ratios were

Sharpe is past president of the American Finance Association, and in 1990 he received the Nobel Prize in economic sciences. He received his Ph.D., M.A., and B.A. in economics from the University of California, Los Angeles.

William Sharpe: Let me take that in pieces. About the first question, there is a point in this observation, which sometimes gets lost, that collectively we hold what is available. At the end of the day, if you add up all the portfo-lios no matter how exotic they may be, and add up the longs and the shorts, you end up with the market. That is just arithmetic, so in a sense the aggregate of all

William Forsyth Sharpe, born in 1934, is an American economist and Professor of Finance at Stanford University. In 1990 he won the Nobel Prize in Economic Sciences along …

The Sharpe Ratio and the Information Ratio Essay . Andrew Roberts Article Summary 3 February 17, 2013 The article, “The Sharpe Ratio and the Information Ratio”, by Deborah Kidd is about the original risk-adjusted performance measure and they are Sharpe ratio and the Information Ratio – The Sharpe Ratio

6/06/2017 · William Sharpe on Pricing and Risk The inventor of one of the most famous concepts in finance discusses smart beta, retirement income and the ratio that bears his name. By

Sharpe Ratio Formula. In 1966, William Sharpe developed this ratio which was originally called it the “reward-to-variability” ratio before it began being called the Sharpe ratio by subsequent academics and financial operators.

First proposed by William Sharpe in his landmark 1966 paper “Mutual Fund Performance,” the original version of the Sharpe ratio was known as the reward-to-variability ratio. Sharpe revised the formula in 1994 to acknowledge that the risk-free rate used as the reference point is variable, not a constant.

The denominator is the standard deviation of excess return, and the resulting quotient is the Sharpe Ratio. The bigger the number, the better the risk-adjusted performance. The bigger the number, the better the risk-adjusted performance.

Mutual Fund Performance UCLA Statistics

Sharpe Ratio Macroption

Title: Mutual Fund Performance Created Date: 20160506170108Z

DESCRIPTION. The research paper presents an equity research analysis of stocks in National Stock Exchange

The study concluded that William Sharpe’s Single Index Model will be sustainable and applicable to the Indian market where investors can construct a portfolio for improving the expected returns on …

What is Sharpe Ratio? A ratio developed by Nobel laureate William F. Sharpe to measure risk-adjusted performance. The Sharpe ratio is calculated by subtracting the risk-free rate – such as that of

Investments, 6th edition, William Sharpe, Gordon Alexander, Modern Portfolio Theory and Investment Analysis, 6th edition, Modern Portfolio Theory and Investment Analysis, 6th edition, Edwin Elton, Martin Gruber,

The Sharpe Ratio, developed by Nobel Prize winner William Sharpe some 50 years ago, does precisely this: it compares the return of an investment to that of an alternative and relates the relative return to the risk of the investment, measured by the standard deviation of returns.

We illustrate how the GSR can mitigate the shortcomings of the Sharpe ratio in resolution of Sharpe ratio paradoxes and reveal the real performance of portfolios with manipulated Sharpe ratios. We also demonstrate the use of this measure in the performance evaluation of hedge funds.

The Sharpe Ratio Sharpe Ratio The Sharpe Ratio is a measure of risk adjusted return comparing an investment’s excess return over the risk free rate to its standard deviation of returns. The Sharpe Ratio (or Sharpe Index) is commonly used to gauge the performance of an investment by adjusting for its risk. , also known as the Sharpe Index, is named after American economist, William Sharpe.

Sharpe Ratio Combines Risk and Return Sharpe is also known for creating the Sharpe Ratio, which is a risk-adjusted measure of investment performance. This continues to be one of the most widely-used performance measures for investment managers.

Since the Sharpe ratio was derived in 1966 by William Sharpe, it has been one of the most referenced. risk/return measures used in finance, and much of this popularity can be attributed to its simplicity.

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at Irvine.

![Paper on William Sharpe Model [PDF Document]](/blogimgs/https/cip/ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/5d041b8fad6aa10fc1afa5d0cef44ff0019c4a5b/2-Figure1-1.png)

William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of the modern theory of finance. His most famous work involves the development of the capital asset pricing model (CAPM), which is now one of the fundamental tools for understanding equilibrium risk–return

The Sharpe ratio (aka Sharpe’s measure), developed by William F. Sharpe, is the ratio of a portfolio’s total return minus the risk-free rate divided by the standard deviation of the portfolio, which is a measure of its risk. The Sharpe ratio is simply the risk premium per unit of risk, which is quantified by the standard deviation of the portfolio.

Sharpe ratio was originally invented by William F. Sharpe in 1966 and introduced in this paper: William F. Sharpe: Mutual Fund Performance ; first published in The Journal of Business, January 1966. Freely available as pdf download on Stanford University website:

The Sharpe Ratio is a measure for calculating risk-adjusted return, and this ratio has become the industry standard for such calculations. It was developed by Nobel laureate William Sharpe.

The Sharpe Ratio is a measure of the risk-adjusted return of an investment. While there are a lot of ways to measure risk, the Sharpe Ratio uses the volatility as measured by the standard deviation of returns. Originally developed by Stanford Professor William Sharpe, it is simply the return of an

The Sharpe Ratio is a risk-adjusted measure developed by Nobel Laureate William Sharpe. It is calculated by using excess return and standard deviation to determine

1/02/2018 · William Forsyth Sharpe is an American economist and the winner of the 1990 Nobel Memorial Prize in Economic Sciences. The Sharpe ratio …

The Sharpe ratio was developed by Nobel laureate William F. Sharpe, and is used to help investors understand the return of an investment compared to its risk.

In 1966, William Sharpe, using mean-variance theory, introduced the Sharpe ratio to do this in a quantifiable fashion. Together with its close analogues, the information ratio, the squared Sharpe ratio …

Sharpe Ratio Corporate Finance Institute

Pursuing for Sharpe S Eagle The Sharpe Series Ebook Do you really need this file of Sharpe S Eagle The Sharpe Series Ebook It takes me 60 hours just to attain the right download link, and another 9 hours to validate it.

William Sharpe: The Capital Asset Pricing Model theory model is a theory of how security prices are formed in an efficient market. It basically comes to two or three key conclusions. One conclusion is that a highly diversified portfolio that’s representative of the market in question – all the stocks, all the bonds, more or less in proportion to what is available – is a very efficient

The Sharpe ratio is measure of risk. It is named after Stanford professor and Nobel laureate William F. Sharpe. This means that for every point of return, you are shouldering 1.17 “units” of risk. Put another way, if portfolio X generates a 10% return with a 1.25 Sharpe ratio and portfolio Y also

This measurement is an adaptation of the Sharpe ratio that was developed by William Sharpe to isolate the affects of volatility on investments. Sharpe wanted to mathematically figure out if different investments’ returns went up and down because of investment performance or simply because of market volatility. This concept was a big leap forward in financial mathematics.

The ex post Sharpe ratio (SR) is a measure of a portfolio’s performance over an evaluation period that is expressed as the portfolio’s average excess return per unit of risk.

commonly known as the Sharpe ratio (SR)) was introduced by William Sharpe in 1966 (Sharpe, 1966). The information ratio (IR) (originally referred to as the ‘appraisal ratio’) was introduced by Jack Treynor and Fischer Black in 1973 (Treynor and Black, 1973). Both are measures of volatility-adjusted performance. The key difference between the two is the definition of ‘excess return

The higher the Sharpe Ratio, the better the fund has performed in proportion to the risk taken by it. The Sharpe ratio is also known as Reward-to-Variability ratio and it is named after William Forsyth

William F. Sharpe William Forsyth Sharpe (born June 16, 1934) is an American economist. He is the STANCO 25 Professor of Finance, Emeritus at Stanford University ‘s Graduate School of Business, and the winner of the 1990 Nobel Memorial Prize in Economic Sciences .

The Sharpe ratio uses standard deviation to measure a fund’s risk-adjusted returns. The higher a fund’s Sharpe ratio, the better a fund’s returns have been relative to the risk it has taken on.

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk. – on success charlie munger pdf The latest Tweets from William Sharpe (@willsharpe). Deputy headteacher ,inspired by digital learning and cognitive science. Passionate about collaboration and innovation in education. Love books and #primaryrocks

In Investors and Markets, Nobel Prize-winning financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has …

An American economist and professor. His major contributions include both the capital asset pricing model and the Sharpe ratio, which attempts to account for a money manager’s index-like tendencies in portfolio management.

William Forsyth Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences, along with Harry Markowitz and Merton Miller, for …

Developed in 1966 by Nobel Laureate William Sharpe, the ratio is used to measure and compare the level of risk in a portfolio. The higher the Sharpe ratio, the better a portfolio has performed relative to the risk taken. As an example, if two portfolio managers, A …

The Sharpe ratio is a measure of a portfolio’s performance in relation to the risk of the portfolio’s investments. The Sharpe Ratio. The Sharpe ratio was created by now Nobel Prize winning economist William Sharpe.

Named after American economist, William Sharpe, the Sharpe Ratio (or Sharpe Index) is commonly used to gauge the performance of an investment by adjusting for its risk. The higher the ratio, the greater the investment return relative to the amount of risk taken, and thus, the better the investment.

18/10/2018 · Named after American economist, William Sharpe, the Sharpe Ratio (or Sharpe Index) is commonly used to gauge the performance of an investment by adjusting for its risk.

Given NUMSERIES assets with NUMSAMPLES returns for each asset in a NUMSAMPLES-by-NUMSERIES matrix Asset and given either a scalar Cash asset return or a vector of Cash asset returns, the Sharpe ratio is computed for each asset.

1 The Sharpe ratio In 1966 William Sharpe suggested that the performance of mutual funds be analyzed by the ratio of returns to standard deviation. [63] His eponymous ratio1, ^, is de ned as 1. Sharpe guaranteed this ratio would be renamed by giving it the unweildy moniker of ’reward-to-variability,’ yet another example of my Law of Implied Eponymy. ^= ^ ^˙; where ^ is the historical, or

The Sharpe Ratio usually uses the standard deviation as its proxy for the volatility to measure a portfolio’s risk-adjusted returns. In conclusion, the higher a portfolio’s Sharpe Ratio is, the

Author: INGERSOLL Created Date: 11/2/2004 3:48:19 PM

Sharpe ratio is a calculation that measures the real return of an investment after adjusting for its riskiness. It is particularly useful when we are comparing at least two investment opportunities, because it levels out market volatility – the returns are flattened as if the risk were eliminated.

William Sharpe is a founding member of the Capital Asset Pricing Model (CAPM), one of the largest capital market equilibrium models under uncertainty. He also developed the Sharpe ratio, an indicator for measuring the risk-return ratio (performance) of investments, the binomial method to price options, the gradient method to optimize the asset allocation (the practical implementation of the

What do you mean by Sharpe ratio? Quora

OPTIMAL PORTFOLIO CONSTRUCTION USING SHARPE’S SINGLE

Sharpe Ratio YouTube

[[PDF Download]] Sharpe S Eagle The Sharpe Series

Portfolio Performance Manipulation and Manipulation-Proof

Compute Sharpe ratio for one or more assets MATLAB

William Sharpe SIEPR

https://da.wikipedia.org/wiki/Sharpekvote

How to Calculate Sharpe Ratio Definition Formula

– viking.som.yale.edu

William Sharpe (@willsharpe) Twitter

William Sharpe an unsung hero of passive investing

Sharpe Ratio Calculator Download Free Excel Template

Markowitz Covariance Model and Sharpe Index Coefficients

Sharpe Ratio YouTube

What is Sharpe Ratio? A ratio developed by Nobel laureate William F. Sharpe to measure risk-adjusted performance. The Sharpe ratio is calculated by subtracting the risk-free rate – such as that of

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) is a way to examine the performance of an investment by adjusting for its risk.

First proposed by William Sharpe in his landmark 1966 paper “Mutual Fund Performance,” the original version of the Sharpe ratio was known as the reward-to-variability ratio. Sharpe revised the formula in 1994 to acknowledge that the risk-free rate used as the reference point is variable, not a constant.

Sharpe ratio which was developed by William Sharpe in 1966, is one of the the most commonly used measures. It shows average return of the portfolio with the each excess risk taken. However, lots of academicians in the literature claimed that Sharpe Ratio does not give correct results especially when returns of the funds display non-normal distributions. Hence, variety of rules and ratios were

Sharpe ratio is a calculation that measures the real return of an investment after adjusting for its riskiness. It is particularly useful when we are comparing at least two investment opportunities, because it levels out market volatility – the returns are flattened as if the risk were eliminated.

The Sharpe Ratio William F. Sharpe Stanford University Reprinted fromThe Journal of Portfolio Management, Fall 1994 This copyrighted material has been reprinted with permission from The Journal of Portfolio Management.

Nobel Laureate William F. Sharpe constructed a “Sharpe ratio”

Risk and Returns The Sharpe Ratio Python – Online

Title: Mutual Fund Performance Created Date: 20160506170108Z

Sharpe ratio was originally invented by William F. Sharpe in 1966 and introduced in this paper: William F. Sharpe: Mutual Fund Performance ; first published in The Journal of Business, January 1966. Freely available as pdf download on Stanford University website:

An American economist and professor. His major contributions include both the capital asset pricing model and the Sharpe ratio, which attempts to account for a money manager’s index-like tendencies in portfolio management.

William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of the modern theory of finance. His most famous work involves the development of the capital asset pricing model (CAPM), which is now one of the fundamental tools for understanding equilibrium risk–return

Sharpe Ratio Formula. In 1966, William Sharpe developed this ratio which was originally called it the “reward-to-variability” ratio before it began being called the Sharpe ratio by subsequent academics and financial operators.

In 1966, William Sharpe, using mean-variance theory, introduced the Sharpe ratio to do this in a quantifiable fashion. Together with its close analogues, the information ratio, the squared Sharpe ratio …

The Sharpe Ratio usually uses the standard deviation as its proxy for the volatility to measure a portfolio’s risk-adjusted returns. In conclusion, the higher a portfolio’s Sharpe Ratio is, the

William Sharpe on Pricing and Risk Bloomberg

Mutual Fund Performance UCLA Statistics

The ex post Sharpe ratio (SR) is a measure of a portfolio’s performance over an evaluation period that is expressed as the portfolio’s average excess return per unit of risk.

William Forsyth Sharpe is an American economist who won the 1990 Nobel Prize in Economic Sciences, along with Harry Markowitz and Merton Miller, for …

Since the Sharpe ratio was derived in 1966 by William Sharpe, it has been one of the most referenced. risk/return measures used in finance, and much of this popularity can be attributed to its simplicity.

Sharpe ratio is a calculation that measures the real return of an investment after adjusting for its riskiness. It is particularly useful when we are comparing at least two investment opportunities, because it levels out market volatility – the returns are flattened as if the risk were eliminated.

Paper on William Sharpe Model [PDF Document]

Sharpe Ratio Definition & Example InvestingAnswers

This article will clarify the difference in Calculation between Markowitz Covariance Model and Sharpe Index Coefficients. Sharpe’s Model: William Sharpe tried to simplify the Markowitz method of diversification of portfolios.

William Sharpe: Let me take that in pieces. About the first question, there is a point in this observation, which sometimes gets lost, that collectively we hold what is available. At the end of the day, if you add up all the portfo-lios no matter how exotic they may be, and add up the longs and the shorts, you end up with the market. That is just arithmetic, so in a sense the aggregate of all

William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of the modern theory of finance. His most famous work involves the development of the capital asset pricing model (CAPM), which is now one of the fundamental tools for understanding equilibrium risk–return

The higher the Sharpe Ratio, the better the fund has performed in proportion to the risk taken by it. The Sharpe ratio is also known as Reward-to-Variability ratio and it is named after William Forsyth

The Sharpe Ratio is a measure of the risk-adjusted return of an investment. While there are a lot of ways to measure risk, the Sharpe Ratio uses the volatility as measured by the standard deviation of returns. Originally developed by Stanford Professor William Sharpe, it is simply the return of an

Sharpe is past president of the American Finance Association, and in 1990 he received the Nobel Prize in economic sciences. He received his Ph.D., M.A., and B.A. in economics from the University of California, Los Angeles.

The Sharpe Ratio is a risk-adjusted measure developed by Nobel Laureate William Sharpe. It is calculated by using excess return and standard deviation to determine

The Sharpe Ratio, developed by Nobel Prize winner William Sharpe some 50 years ago, does precisely this: it compares the return of an investment to that of an alternative and relates the relative return to the risk of the investment, measured by the standard deviation of returns.

The Sharpe Ratio William F. Sharpe Stanford University Reprinted fromThe Journal of Portfolio Management, Fall 1994 This copyrighted material has been reprinted with permission from The Journal of Portfolio Management.

6/06/2017 · William Sharpe on Pricing and Risk The inventor of one of the most famous concepts in finance discusses smart beta, retirement income and the ratio that bears his name. By

We illustrate how the GSR can mitigate the shortcomings of the Sharpe ratio in resolution of Sharpe ratio paradoxes and reveal the real performance of portfolios with manipulated Sharpe ratios. We also demonstrate the use of this measure in the performance evaluation of hedge funds.

Developed in 1966 by Nobel Laureate William Sharpe, the ratio is used to measure and compare the level of risk in a portfolio. The higher the Sharpe ratio, the better a portfolio has performed relative to the risk taken. As an example, if two portfolio managers, A …

Author: INGERSOLL Created Date: 11/2/2004 3:48:19 PM

Sharpe Ratio Investopedia

Compute Sharpe ratio for one or more assets MATLAB sharpe

William Sharpe, 1990 co-winner of the Nobel Prize in economics, is one of the founders of the modern theory of finance. His most famous work involves the development of the capital asset pricing model (CAPM), which is now one of the fundamental tools for understanding equilibrium risk–return

The Sharpe Ratio is a risk-adjusted measure developed by Nobel Laureate William Sharpe. It is calculated by using excess return and standard deviation to determine

The Sharpe ratio was developed by Nobel laureate William F. Sharpe, and is used to help investors understand the return of an investment compared to its risk.

The Sharpe Ratio Sharpe Ratio The Sharpe Ratio is a measure of risk adjusted return comparing an investment’s excess return over the risk free rate to its standard deviation of returns. The Sharpe Ratio (or Sharpe Index) is commonly used to gauge the performance of an investment by adjusting for its risk. , also known as the Sharpe Index, is named after American economist, William Sharpe.

6/06/2017 · William Sharpe on Pricing and Risk The inventor of one of the most famous concepts in finance discusses smart beta, retirement income and the ratio that bears his name. By

The Sharpe Ratio William F. Sharpe Stanford University Reprinted fromThe Journal of Portfolio Management, Fall 1994 This copyrighted material has been reprinted with permission from The Journal of Portfolio Management.

The ex post Sharpe ratio (SR) is a measure of a portfolio’s performance over an evaluation period that is expressed as the portfolio’s average excess return per unit of risk.

William F. Sharpe is the STANCO 25 Professor of Finance, Emeritus, at Stanford University’s Graduate School of Business. He joined the Stanford faculty in 1970, having previously taught at the University of Washington and the University of California at Irvine.

The Sharpe Ratio is a measure of the risk-adjusted return of an investment. While there are a lot of ways to measure risk, the Sharpe Ratio uses the volatility as measured by the standard deviation of returns. Originally developed by Stanford Professor William Sharpe, it is simply the return of an

The higher the Sharpe Ratio, the better the fund has performed in proportion to the risk taken by it. The Sharpe ratio is also known as Reward-to-Variability ratio and it is named after William Forsyth

William Forsyth Sharpe, born in 1934, is an American economist and Professor of Finance at Stanford University. In 1990 he won the Nobel Prize in Economic Sciences along …

Author: INGERSOLL Created Date: 11/2/2004 3:48:19 PM

William Sharpe financial definition of William Sharpe

What do you mean by Sharpe ratio? Quora

Sharpe Ratio Definition & Example InvestingAnswers

Sharpe ratio was originally invented by William F. Sharpe in 1966 and introduced in this paper: William F. Sharpe: Mutual Fund Performance ; first published in The Journal of Business, January 1966. Freely available as pdf download on Stanford University website:

OPTIMAL PORTFOLIO CONSTRUCTION USING SHARPE’S SINGLE

Author: INGERSOLL Created Date: 11/2/2004 3:48:19 PM

Risk and Returns The Sharpe Ratio Python – Online

The Sharpe ratio is measure of risk. It is named after Stanford professor and Nobel laureate William F. Sharpe. This means that for every point of return, you are shouldering 1.17 “units” of risk. Put another way, if portfolio X generates a 10% return with a 1.25 Sharpe ratio and portfolio Y also

Sharpe Ratio Macroption

Sharpe Ratio – What is the Sharpe Ratio? – Begin To Invest